Wynn Tipped as Top Casino Stock Idea for 2025

After a challenging 2024 where the stock dropped over 5%, significantly underperforming the overall market, Wynn Resorts (NASDAQ: WYNN) is gaining recognition on Wall Street as certain analysts see it as a potential rebound story for casino stocks in 2025.

In a recent report regarding gaming and leisure stocks, Stifel analyst Steven Wieczynski identified Wynn as the firm’s leading large-cap casino selection for 2025, while reaffirming a “buy” rating and a $123 price target on the stock. That indicates a potential increase of 46% from the close on January 3. Wynn is frequently perceived through the perspective of Macau, where it runs two integrated resorts. Although gaming stocks underperformed last year, gross gaming revenue (GGR) rose, prompting analysts to think that firms with ties to the casino enclave are significantly undervalued at present.

"We think Macau’s fundamentals should continue to improve on accessibility improvements & consumer sentiment, and forecast market-wide GGR growth in the range of 4% to 10% for 2025, in line with the consensus estimate,” observed Wieczynski.

The analyst mentioned that Macau's GGR is expected to stay under pre-pandemic levels this year, yet it is still set to increase. Additionally, projections for Macau gaming stocks, such as Wynn, do not currently account for the potential of additional monetary stimulus from China.

Premium Reputation Might Position Wynn Casino Stock for Success

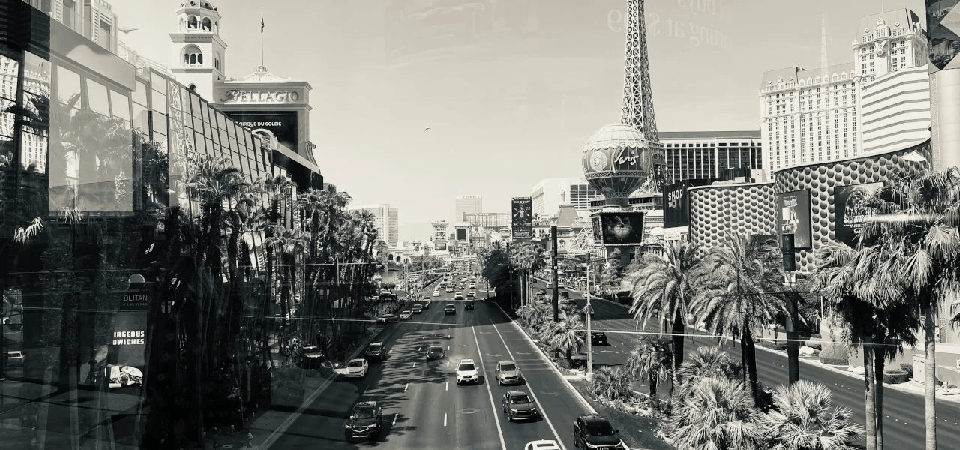

Whether in Las Vegas or Macau, Wynn is known for running premium casino hotels that draw wealthy guests.

In Macau, this is beneficial since high rollers and VIPs are less affected by fluctuations in the Chinese economy compared to mass-market consumers. This year, certain Macau operators may depend on the People’s Bank of China (PBOC) providing additional economic stimulus, but Wynn Macau is not as reliant on that situation because of its wealthy clientele.

In its local market of Las Vegas, Wynn, similar to its rivals, is expected to encounter challenging year-over-year comparisons in the initial half of this year, but that condition should ease in the latter half of 2025, possibly positioning the casino stock for some growth.

“The Strip’s draw as a premier global sports and entertainment destination is only becoming more powerful, and WYNN’s asset quality remains unmatched at the high end of the market, where demand is most resilient, in our view,” adds Wieczynski. “The company also has a substantial land bank of prime Strip real estate that provides optionality for further development down the road.”

UAE Casino May Enhance Wynn Stock

With Wynn Al Marjan Island expected to launch in roughly two years and the hotel tower in the initiative planned to be completed by late 2025, the inaugural casino resort endeavor in the Arab world's history might boost shares of Wynn as the year progresses.

Wieczynski observed that the UAE project is a undervalued component of Wynn's overall investment strategy and the partnership might add $10 to $17 to the stock price.

“Putting it all together, we believe a sentiment shift and improving market fundamentals in Macau should ultimately warrant a re-rating for WYNN shares over the medium term, while the Las Vegas operations provide a sturdy base of free cash flow generation to fund long-term opportunities in the growth pipeline,” concluded the analyst.