Light & Wonder Stock Hindered by Legal Woes, Says Analyst

Shares of Light & Wonder (NASDAQ: LNW) dropped close to 11% last Friday, a decline that continued into Monday’s trading hours, as investors consider the chance that Aristocrat Leisure’s lawsuit against the firm might be broadened to cover an additional slot game.

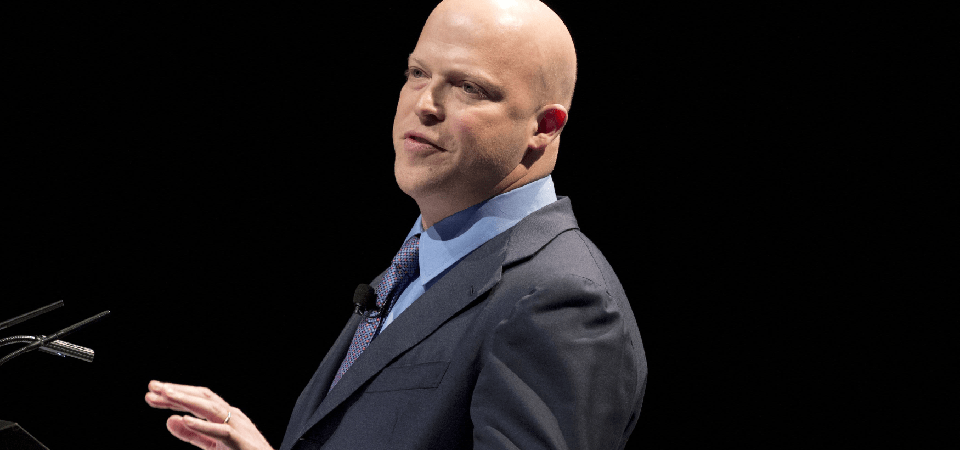

In a report on Friday after discussions with Light & Wonder management, Macquarie analyst Chad Beynon mentioned there’s “further legal correspondence” concerning the company’s “Jewel of the Dragon” slot series, which might be included in the lawsuit initiated last year against the manufacturer by competitor Aristocrat.

"This raises the question of why Aristocrat might be pursuing further legal action towards ‘Jewel of the Dragon’ when signs point to any potential impact to LNW’s business as de minimis,” observes Beynon. “We are not going to speculate here, but we think the main takeaway is that LNW’s exposure with ‘Jewel of the Dragon’ should be significantly lower than with ‘Dragon Train.’”

In September of last year, Aristocrat Technologies secured a preliminary injunction preventing Light & Wonder from additional leases and sales of “Dragon Train” slot machines. Judge Gloria Navarro of the US District Court for the District of Nevada determined that Aristocrat is very likely to demonstrate its rival “misappropriated Aristocrat’s trade secrets” from its “Dragon Link” games in creating “Dragon Train.” When the lawsuit was first submitted in June 2024, the name “Jewel of the Dragon” was referenced, suggesting it’s not unexpected that Aristocrat might seek to incorporate it into the larger legal proceedings.

Light & Wonder Has Acted to Address the Issue

Earlier, L&W’s Dragon family of games achieved popularity among bettors in Australia, and certain analysts indicated that the new series might serve as a driver for increased earnings before interest, taxes, depreciation, and amortization (EBITDA) projections. Aristocrat is engaged in legal action against L&W in that nation, and earlier this year, a federal court granted it pre-suit discovery from L&W.

Aristocrat contended that the L&W game resembled its “Dragon Link” — a thriving slots series on its own. In a legal filing from June 2024, the Australian firm also highlighted resemblances between “Jewel of the Dragon” and “Dragon Link.”

“Aristocrat highlights similarities between the Red Phoenix version of the Jewel of the Dragon game and its own Autumn Moon game, including similarities between the Hold and Spin features, the jackpot displays, and the logos,” adds Beynon.

The initial lawsuit led Light & Wonder to remove “Dragon Train” slots from Australia and North America; however, those machines were substituted with other titles from the manufacturer’s lineup, and while “Dragon Train” enjoyed popularity, it wasn’t a significant contributor to the producer’s revenue.

Improbable to Impact L&W EBITDA Objectives

Light & Wonder has consistently projected a consolidated adjusted EBITDA of $1.4 billion for 2025, and the positive aspect is that even if Aristocrat broadens the earlier lawsuit to cover “Jewel of the Dragon,” that earnings target remains attainable.

“As it stands, our view is that this development does not derail LNW’s path to reaching its $1.4 billion 2025 EBITDA target,” concludes Beynon.

He assigns the stock a rating of "outperform" and sets a 12-month price target of $125.